Debt and the Federal Reserve

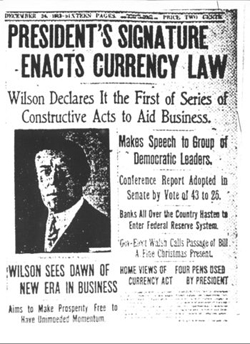

This excerpt from Debt Virus by Dr. Jacques Jaikraan, page 216 is very revealing. The “Federal” Reserve Act of 1913, requires the central bank to return a small portion of its unconstitutional gains to the U.S. Treasury.

Here is an example of the numbers:

“In 1988 the Federal Reserve has an income of 19.5 billion, and it turned back $17.36 billion to the U.S. Treasury as provided under its charter.

The Federal Reserve Act of 1913 provided that a substantial portion of the Feds annual profits be turned over to the National Treasury. Does this fact dilute the argument that there are vast profits built into the commercial banking system? No. Consider for a moment that the total debt (public debt plus private debt) at the end of 1988 was in excess of $11 trillion. [Editorial note: Today it is in excess of $23 trillion.] Then, the discount rate, the rate at which banks can borrow from the Federal Reserve, was about 9.4%. Assuming the debt carried the same rate as the discount rate, there was an annual interest charge of almost $1 trillion on the total debt owed to the banking system.

The Federal Reserve Act of 1913 provided that a substantial portion of the Feds annual profits be turned over to the National Treasury. Does this fact dilute the argument that there are vast profits built into the commercial banking system? No. Consider for a moment that the total debt (public debt plus private debt) at the end of 1988 was in excess of $11 trillion. [Editorial note: Today it is in excess of $23 trillion.] Then, the discount rate, the rate at which banks can borrow from the Federal Reserve, was about 9.4%. Assuming the debt carried the same rate as the discount rate, there was an annual interest charge of almost $1 trillion on the total debt owed to the banking system.

While all of this interest payment does not go to commercial banks, an overwhelmingly large part of it does. The $17.36 billion turned over to the U.S. Treasury is thus much less than 2% of the total carrying charge on the total debt. which they created out of thin air. Now can you appreciate what is happening?”

The current debt based system is designed to keep you and your children enslaved in a perpetual system of ever growing debt. Current global economic crises are symptoms of a unsustainable debt system that will eventually collapse leaving most people destitute and desperate for relief.

Rather than trusting your money in the debt based paper currency market, you should be storing away some silver and gold. This can be easily done by dollar cost averaging your precious metal purchases now.